Circular businesses models ‘mitigate volatile resource prices’

‘Global commodity prices are notoriously volatile’ according to London-based environmental think-tank Green Alliance, making it difficult for analysts to predict potential future price rises or falls, but circular economy business models could help mitigate investment risk in this area.

This assertion underpins the organisation’s new report ‘Managing Resources for a Resilient Economy’, aimed at ‘those whose role it is to help businesses manage resource risks better’, in a bid to utilise financial risk-management techniques to prove the efficacy of resource efficiency approaches as sound investment decisions.

The report compares IMF forecasting data between 1997 and 2013 with actual changes in commodity prices (both oil and non-oil) to highlight the inherent difficulties that ‘even large and well-resourced organisations’ face when attempting to predict future fluctuations and trends.

Crucially, this matters due to the substantial effect that commodity prices have on the UK economy. According to Green Alliance the UK is a net importer of energy (43 per cent in 2012) and food (38 per cent in 2012), exposing the country to global commodity price developments with ‘significant implications for inflation, living standards and GDP’.

In addition to energy and food, the report highlights a number of ‘critical’ raw materials such as metals and minerals that are important to UK supply chains, these include: antimony (used as a hardener in semiconductors, and the production of lead acid batteries and flame retardants); dysprosium (a rare earth element used in permanent magnets for electric cars and wind turbines); indium (used in coating LCD touchscreens and for the production of low melting point alloys and solders, and the in photovoltaic films for solar panels); and phosphate rock (primarily used in the chemical industry to produce fertilisers and animal feed supplements).

Supply of these resources is reportedly concentrated in a few regions such as China and Russia, representing a risk to supply as ‘strong demand growth is anticipated for the current decade’ and shocks can ‘drastically disturb national and global supply chains’.

Mitigating supply chain risk

The report highlight three main approaches to risk used by analysts to achieve a healthy return on investments whilst accommodating acceptable levels of risk. These are:

- lower weight for volatile investments – analysts employ the ‘Sharpe ratio’ to assess the expected return on an asset minus the risk free return (such as the yield on a government bond) divided by the volatility of the asset. Risky investments require a higher expected return than safer ones.

- portfolio diversification – analysts may combine assets with differing returns to create portfolios that offer higher returns for a given level of risk.

- minimising large losses and ‘fat tail’ risk – approaches based on assumptions of normal probability distributions such ‘Value at Risk (VAR) can provide unreliable predictions. Similarly models based on historical data can break down, meaning that a range of scenarios needs to be considered when forming predictions.

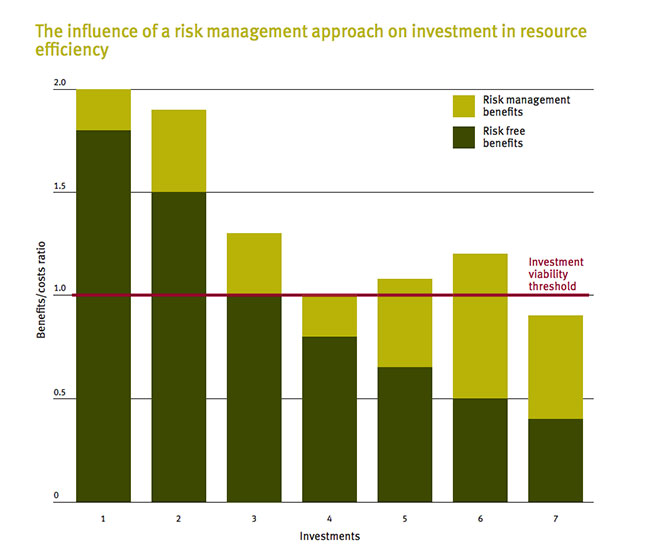

The consultancy then goes on to suggest that circular business models offer ‘risk management benefits from a national perspective’ in the form of ‘reduced sensitivity to changes in commodity availability or prices, improving output, employment or inflation’. The report goes on to take a look at several studies that estimate the cost effectiveness of resource efficiency investments in energy, land, water and steel.

It concludes that financing circular businesses could:

- help the economy gain from diversification, as the costs of financing resource efficiency projects are ‘unlikely to be correlated with resource prices’;

- help support a domestic supply source of materials, reducing the impact of price fluctuations, and protecting against future price rises even if they are currently low; and

- offer the broadest range of benefits in terms of portfolio diversification’ as they have the potential of ‘managing the wide range of resource risks embodied in products, including risks for energy resources, which would still be required for recycling, and all other materials embedded in the product’.

Fundamentally, Green Alliance adds, ‘keeping all the materials in products in use for longer is more resilient than recycling’.

A role for government

Green Alliance argue that the government should position itself as a ‘portfolio manager’ seeking to shape the development of an economy protected against commodity shocks.

According to the report, it can do this through ‘effective industrial policy, support for R&D, innovation and skills development in resource efficiency, and by overcoming barriers to the development of circular systems and infrastructure’.

Read the full ‘Managing Resources for a Resilient Economy’ report or find out more about how circular business models 'challenge' standard banking solutions.