Residual waste going to Energy-from-Waste rises by 16 per cent

The amount of residual waste being processed at energy-from-waste (EfW) facilities in the UK rose by 18 per cent in 2016, according to waste and bioenergy consultancy Tolvik Consulting.

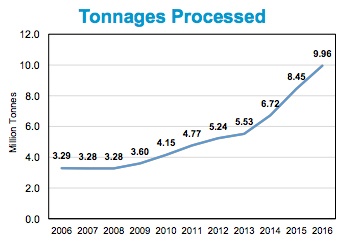

Tolvik’s ‘UK Energy from Waste Statistics – 2016’ report, published this month, concludes that 9.96 million tonnes (Mt) of residual waste was processed in UK EfW plants in 2016, compared to 8.45Mt in 2015.

The 2016 figure represents 92.7 per cent of the headline capacity for facilities operational throughout the year, and continues a sharp increase in tonnage received over recent years. While total tonnage only rose from 3.29Mt to 5.53Mt over the seven years between 2006 and 2013, since then the figure has risen by over a million tonnes annually, and almost doubled in three years.

Of this record-high input, 85.1 per cent of EfW inputs were derived from local authority (LA) collected residual waste, with the rest coming from commercial and industrial (C&I) sources, a proportion that is consistent with 2015 numbers. Tolvik estimates that 47 per cent of LA-sourced residual waste was sent to EfW facilities in the UK, with a further 10 per cent exported as refuse-derived fuel (RDF).

According to the figures collated in the report, the total power exported by EfW sites in the UK in 2016 was 5,208 gigawatt hours (GWh) – approximately 1.8 per cent of total UK generation in 2016 and a 12 per cent increase on 2015.

However, the report also highlights that the average power generated per tonne of input fell during 2016 when compared with 2015, as a couple of larger EfWs experienced lower power export than expected due to turbine issues during the year.

Development and market share

According to the statistics, 37 sites were fully operational in the UK as of December 2016, with four more in the commissioning phase, providing a headline capacity of 11.76Mt a year, with a further 4.08Mt of capacity in construction. This will, based on current developments, increase to 14.70Mt in 2020.

In the future, the report predicts that EfW facilities most likely to be developed will be ACT (advanced conversion technology) plants or larger scale plants based on conventional moving grate technologies.

Among EfW operators, Veolia and Viridor had the highest market shares amongst inputs in 2016, taking 23.8 per cent (2.37Mt) and 21.9 per cent (2.18Mt) of the residual waste for processing respectively. There was then a significant drop off to SUEZ in third (12.1 per cent, 1.21Mt) and FCC Environment in fourth (11.6 per cent, 1.15Mt).

The average availability at EfW facilities rose to 90.2 per cent in 2016 (2015 – 88.3 per cent), and Veolia once again topped the chart for average availability (94.3 per cent), with the top six highest reported availabilities all coming from sites operated by the French firm. Second and third places came from Cory (93.2 per cent) and MES Environmental (90.5 per cent).

No operator averaged less than 86 per cent and with just one exception, in 2016 all EfW sites had an average availability of more than 81 per cent.

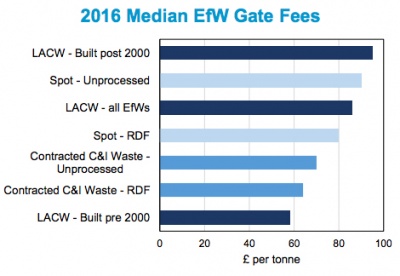

Median 2016 Gate Fees

Sources: WRAP Gate Fee Report, Tolvik Analysis

Gates fees

Median 2016 Gate Fees

Sources: WRAP Gate Fee Report, Tolvik Analysis

Gates fees

Median gate fees for EfW were generally up from 2015 figures, ranging from £58 to £95 per tonne in 2016, depending on the source, type of waste and contract duration.

Tolvik suggests that this increase reflects the increasing cost of alternatives – in particular landfill (where the number of operational landfills continued to decline and landfill tax rose) and RDF export (weak exchange rate, strengthening European EfW markets).

Specifically, local authority waste had a median gate fee of £86 per tonne, unchanged from 2015. However, median gate fees for long term contracts for residual C&I waste rose to £70 per tonne (from £62), whist median spot market prices to EfWs were much higher at around £92 per tonne.

Tolvik’s ‘UK Energy from Waste Statistics – 2016’ can be read and downloaded from the company’s website.