Northern Europe heading for residual treatment overcapacity

Overcapacity of residual waste treatment will exist across Northern Europe from 2026, according to the tenth issue of Eunomia Research & Consulting’s biannual ‘Residual Waste Infrastructure Review’.

Overcapacity of residual waste treatment will exist across Northern Europe from 2026, according to the tenth issue of Eunomia Research & Consulting’s biannual ‘Residual Waste Infrastructure Review’.

The company has published a review of residual waste treatment capacity in the UK on a twice-yearly basis for the last five years. During that time, it says, ‘the residual waste market has been transformed from one whose geography was largely defined by a country’s borders to one that has become truly European in nature’.

Significant tonnages of refuse-derived fuel (RDF) and solid recovered fuel (SRF) are now moved across borders. In the UK, 3.4 million tonnes of RDF and SRF are now exported every year, compared to around 250,000 tonnes in 2011.

Because of this, Eunomia decided for this edition of the review to also consider the balance of supply and demand across a group of an additional 10 European member states: Ireland, The Netherlands, Germany, France, Belgium, Denmark, Sweden, Norway, Poland and the Czech Republic.

All of these member states and the UK are all actively involved in trading RDF or SRF with others within the group and therefore form a natural ‘cluster’ of countries in Northern Europe, referred to in the report as the ‘Northern Cluster’.

Northern Cluster

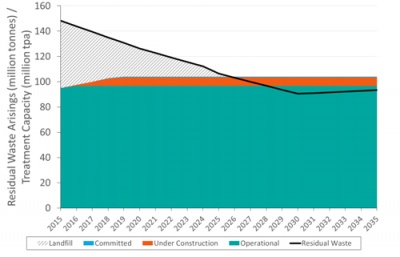

Currently, the 11 countries within the Northern Cluster have a combined 104.2 million tonnes per year of ‘effective’ residual waste treatment capacity. This includes projects that are under construction or have reached financial close, as well as those that are already operational.

This capacity is provided by: 383 dedicated incineration facilities; 13 advanced conversion technology (ACT) facilities; 103 pre-treatment facilities (using either mechanical-biological treatment (MBT) or autoclave technologies); 73 biomass facilities; and 102 cement kilns capable of processing SRF.

These currently work to treat the 148.5 million tonnes of residual waste generated throughout the 11 nations. However, once these facilities are fully utilised, Eunomia warns that the capacity will exceed the 90.4 million tonnes of residual waste these nations are expected to produce in 2030.

The report also says that the UK has the third biggest gap between its residual waste generation (25.9 million tonnes) and treatment capacity, and of the 19.5 million tonnes of ‘effective’ treatment capacity in the country, almost five million is still under construction or in development.

However, Eunomia says that the 65 per cent recycling target for member states by 2030, set out in the European Commission’s Circular Economy Package, has added to the momentum created by the 50 per cent target for 2020 included in the Waste Framework Directive. The reductions in residual waste modelled by Eunomia, therefore, indicate that by 2030 the UK will move to a capacity surplus, so much so that the consultancy predicts the country will go from having the third highest undercapacity to the third highest overcapacity.

Across the Northern Cluster, the review projects that the capacity gap will fall from the current level of 53 million tonnes to a situation of potential overcapacity from 2026 onwards. It predicts that the level of excess supply of treatment capacity will then rise to 13.6 million tonnes a year by 2030, before decreasing to 10.6 million tonnes by 2035 due to continued growth in waste arisings with no further gains in recycling predicted.

UK

Looking at the UK specifically, initial data published by the Environment Agency for the first three months of 2016 suggests that this year is on track to exceed 2015 in terms of RDF exported from this country, which Eunomia assumes will increase to 3.7 million tonnes for 2016. It expects this figure to level out in the following years.

The review says that the decision of American gas producer Air Products to abandon construction of its two Tees Valley incinerators in April has raised questions about the technical capability of ACT technologies, putting extra interest on the eight ACT facilities currently being developed in the UK.

It also points out that should the UK vote to leave the EU in next month’s referendum, a long period of uncertainty over whether the recycling targets set out above would still apply would follow. Because of this uncertainty, Eunomia says that the implications of a vote to leave the EU are still unknown, while there could also be implications for the export of RDF from the UK.

Eunomia’s continued assertion that the UK will exceed the waste infrastructure needed in the future conflicts with a report released in September by waste management company Biffa. That report stated that the capacity gap ‘will not disappear completely’ as market forces will lead to a natural balance of capacity. Instead, it predicted that the current capacity gap of 15 million tonnes per year could be reduced to 4.36 million tonnes per year by 2025 with a progressive circular economy.

Releasing its ninth review in December, Eunomia explained that its studies agree with other reports, such as Biffa’s, in terms of current capacity, but that differing conclusions resulted from ‘pairing a similar capacity estimate to Eunomia’s with a higher estimate of residual waste; or a similar estimate to Eunomia’s assessment of available waste with a lower figure for capacity’.

The tenth issue of Eunomia’s Residual Waste Infrastructure Review can be downloaded from the company’s website.