Exports of RDF from England fall once again

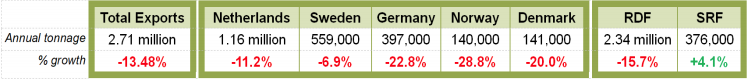

Exports of refuse derived fuel (RDF) and solid recovered fuel (SRF) from England fell by 13.5 per cent in 2019 as markets continue to tighten.

New data from the Environment Agency and presented by Footprint Services shows that 2.71 million tonnes of RDF/SRF were exported from England in 2019, down from 3.13 million tonnes in 2018 and 3.46 million tonnes in 2017.

All of England’s main RDF/SRF export destinations received lower tonnages from England in 2019, with exports to the UK’s largest export market, the Netherlands, falling by 11.2 per cent to 1.16 million tonnes. Sweden (6.9 per cent), Germany (22.8 per cent), Norway (28.8 per cent) and Denmark (20 per cent) all also recorded large drops.

RDF is comprised of high-calorific residual wastes that can be used in fuel for energy recovery, while SRF is a fuel produced from non-hazardous waste in compliance with the EU standard EN 15359, with the net calorific value of the SRF specified by the producer.

The export outlook for RDF/SRF has been challenging in recent times, with the Netherlands set to impose an import tax of €32 per tonne of RDF, a move that is expected to increase the cost for exporters significantly.

Commenting on the figures, Robert Corijn, Chair of the RDF Industry Group and Marketing Manager at Attero B.V., said: “The reduction in the provisional RDF export tonnages for 2019 reflect both the uncertainty caused by the continual spectre of a no-deal Brexit, as well as the interruption to Dutch exports over a period of several months due to capacity issues over the summer and autumn of 2019. These capacity issues are now resolved, and as the UK is in its transition period exports of RDF will continue to be frictionless throughout 2020. We anticipate export tonnages to recover in the short term as the UK still requires the flexible residual waste treatment capacity that export provides, although at a somewhat lower level due to the Dutch import tax.”

In light of export difficulties and the UK Government’s desire to process more waste at home, new domestic residual waste capacity has come online in recent times, such as energy-from-waste facilities at Javelin Park in Gloucestershire, with several more achieving planning permission.

Country Manager at Geminor UK Ltd, James Maiden, said: “2019 was a challenging market for UK export, mostly due to issues surrounding Brexit, the Dutch temporary import restrictions and an increase in UK domestic capacity and facilities. We expect these conditions to continue into 2020, where the Dutch and Swedish tax announcements will impact on UK flows.”

In terms of companies exporting RDF/SRF, Geminor UK Ltd remained the top exporter for the second consecutive year, sending 311,907 tonnes abroad, followed by Biffa and SUEZ UK, with 311,408 tonnes and 296,050 tonnes respectively.

However, all companies experienced a fall in exports, with Geminor’s exports down by 26 per cent, Biffa’s down by 13 per cent and SUEZ’s down by 15 per cent.

Read more: The difference between RDF and SRF

The issue of Brexit’s impact on waste exports remains a live one. The RDF Industry Group, whose members are drawn from across the RDF supply chain, and the waste management industry have previously called on the UK Government and the EU to ensure the export of RDF from the UK to mainland Europe can continue post-Brexit.

While the Department for Environment, Food and Rural Affairs (Defra) confirmed that the trade of waste materials would continue following the UK’s departure from the EU in March 2019, with 100 per cent of the UK’s notified waste shipments to the EU to be maintained in the event of a ‘no deal’ Brexit on 29 March 2019, former Environment Secretary Michael Gove confirmed on Monday (10 February) that trade barriers and border controls will be imposed once the Brexit transition period ends on 1 January 2021.

This could prove significant if waste exporters experience delays at container ports. With 15 per cent of the 3.6 million tonnes of RDF the UK sends to mainland Europe every year travelling through the Port of Dover, changes and disruptions to border controls will cause significant backlogs at the port.

You can view the data on RDF exports in the RDF Dashboard section on the Footprint Services website.