EAC launches special inquiry into effects of China waste ban

Parliament’s Environmental Audit Committee (EAC) has launched an inquiry into the impact of China’s recent import ban on 24 types of plastic and paper waste, calling for urgent submissions of evidence from across the industry.

In force since 1 January, the ban covers 24 grades of solid wastes, including mixed papers and post-consumer plastics, and on 1 March this will extend to any other materials exceeding 0.5 per cent contamination levels.

Before the ban, the UK was sending around 494,000 tonnes of plastics and 1.4 million tonnes of recovered paper to China every year; since news of the measures broke in July last year, the UK recycling industry has been in turmoil as companies rush to find other destinations for their waste, whether at home or elsewhere abroad.

“We will examine the environmental impact of the ban, whether the government has made adequate preparations and what the government can do to ensure the UK’s waste is managed sustainably.”

Call for evidence

The EAC’s inquiry is inviting submissions on some or all of the following questions:

- How much waste within the banned categories does the UK currently export abroad, and what proportion is sent to China?

- What short term and long term issues will the Chinese ban create for waste management and recycling in the UK?

- What are the environmental implications of the Chinese ban?

- What preparations has the UK Government made ahead of the Chinese ban and are these preparations sufficient to deal with the degree of change the ban will cause?

- Have there been preparations to export waste elsewhere? What degree of control does the UK have over how waste is handled once it has been exported?

The EAC will be accepting submissions until Friday 19 January, in advance of a one-off evidence session with government ministers and industry stakeholders.

Aside from canvassing the views of the wider industry, many will be hoping that the inquiry elicits a little more urgency from the Department for the Environment, Food and Rural Affairs (Defra) than that currently shown.

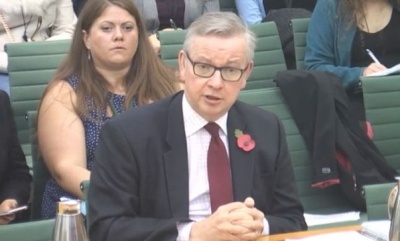

In November 2017, Environment Secretary Michael Gove admitted to the EAC that he had not given the issue “sufficient thought” but that he was certain the UK had the capacity to process extra material. More recently, Gove acknowledged in a written statement that the ban could ‘cause some issues in the short term’ for the country’s recycling.

Quality and markets

While certain businesses have moved their exports to pastures new, above all to alternative South East Asian destinations such as Vietnam, Indonesia and Thailand, Simon Ellin, Chief Executive of the Recycling Association, commented earlier this month that some smaller companies have struggled to find markets for excess materials: “You can already see the impact if you walk round some of our members’ yards. Plastic is building up and if you were to go around those yards in a couple of months’ time the situation would be even worse.”

Ellin stressed the importance of improving the quality of recyclate, given that foreign markets willing to accept the standard China has rejected are now in higher demand. “The UK needs to make further improvements to quality so that we are the preferred suppliers for new markets. This will involve supply chain responsibility, starting at the design stage, through to retailers, councils and the public.

“[W]e need guidance, legislation and investment from government and a coherent, innovative and joined up waste and recycling policy that embraces the Chinese ban and uses it as an opportunity to overhaul our current system and invest at home.”

The need for development of domestic markets for secondary materials has been raised by a number of industry leaders, including Ray Georgeson, head of the Resource Association, who called for “bold and radical” leadership from the government on the issue of plastic waste specifically.”